Cut Interest Rates | Web Scraping Tool | ScrapeStorm

Abstract:Cutting interest rates refers to a monetary policy tool used by the central bank to adjust money supply and capital costs by lowering benchmark interest rates (such as deposit rates, loan rates or policy rates). ScrapeStormFree Download

ScrapeStorm is a powerful, no-programming, easy-to-use artificial intelligence web scraping tool.

Introduction

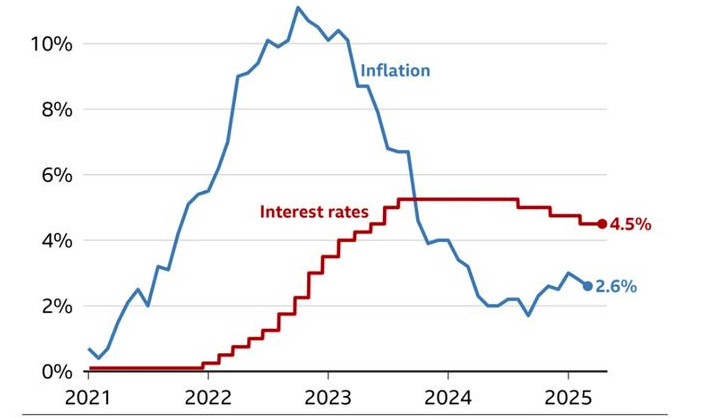

Cutting interest rates refers to a monetary policy tool used by the central bank to adjust money supply and capital costs by lowering benchmark interest rates (such as deposit rates, loan rates or policy rates). Its core purpose is to stimulate economic growth, ease deflationary pressure or respond to economic recession.

Applicable Scene

Cutting interest rates are applicable when economic growth is weak, deflation risks are rising, or financial market liquidity is tight. They can stimulate investment and consumption and promote economic recovery by reducing financing costs.

Pros: Reduce borrowing costs, stimulate corporate investment and household consumption, and promote economic growth; ease corporate debt pressure, improve market liquidity, and stabilize financial market confidence.

Cons: It may lead to a decline in savings returns, trigger capital outflow and currency depreciation, and push up the prices of imported goods; excessive interest rate cuts may exacerbate inflationary pressure or asset bubbles (such as real estate and stock markets), and increase financial risks.

Legend

1. Cutting interest rates.

2. Cutting interest rates.

Related Article

Reference Link

https://www.equiti.com/sc-en/news/trading-ideas/cutting-interest-rates-what-it-means-for-traders/

https://www.investopedia.com/four-reasons-the-fed-isn-t-cutting-interest-rates-11757580