Stock Index | Web Scraping Tool | ScrapeStorm

Abstract:Stock Index is an indicator used to measure the performance of a specific stock market, industry or a specific stock portfolio. ScrapeStormFree Download

ScrapeStorm is a powerful, no-programming, easy-to-use artificial intelligence web scraping tool.

Introduction

Stock Index is an indicator used to measure the performance of a specific stock market, industry or a specific stock portfolio. It is usually calculated by the weighted average of the prices of a certain number of stocks so that investors can understand the overall performance of the market. A stock index, also known as a stock price index, is an indicator that reflects the overall level and changes of various stock market prices in the entire stock market. These indices are compiled by stock exchanges or financial service institutions to indicate the changes in stock market prices.

Applicable Scene

Investors can formulate investment strategies based on the trend of stock indexes. For example, they can increase investment when the market is rising and reduce investment when the market is falling. Stock indexes help investors assess market risks. When stock indexes fall, it may mean that the overall market is sluggish. At this time, investors can adjust their investment portfolios in time to reduce risks.

Pros: Stock indexes can fully reflect the overall performance of the market, avoiding the tediousness of understanding the price changes of multiple stocks one by one. In order to meet the needs of investors, almost all stock markets publish stock price indexes immediately when stock prices change, which helps investors understand market dynamics in real time. Stock indexes not only provide market references for investors, but also provide a basis for the press, company bosses, etc. to observe and predict economic development trends.

Cons: The calculation of stock indexes requires the selection of a certain number of sample stocks, but sometimes these sample stocks may not represent the situation of the entire market. Especially in market capitalization-weighted indices, a few large stocks may dominate the entire index. Stock indexes cannot be broken down into the performance of each individual stock and cannot accurately show the trend of individual stocks. Therefore, if investors only focus on stock indexes, they may overlook some potential individual stocks.

Legend

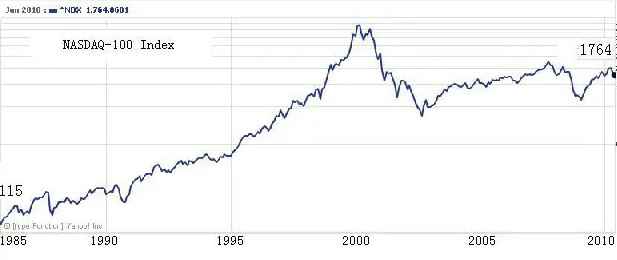

1. Stock index.

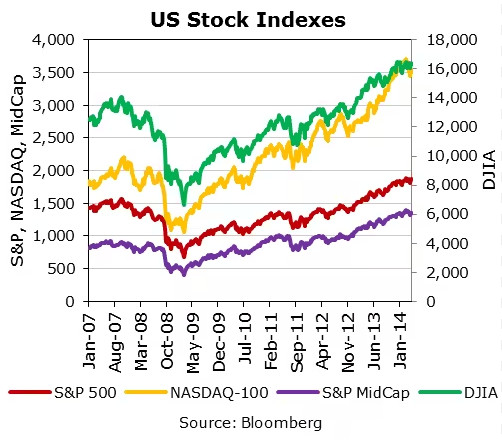

2. US stock indexes.