Reserve Requirement Ratio Cut (RRR Cut) | Web Scraping Tool | ScrapeStorm

Abstract:A reserve requirement ratio cut (RRR) is a monetary policy that reduces the reserve requirement ratio (RRR) that the central bank requires commercial banks to maintain. ScrapeStormFree Download

ScrapeStorm is a powerful, no-programming, easy-to-use artificial intelligence web scraping tool.

Introduction

A reserve requirement ratio cut (RRR) is a monetary policy that reduces the reserve requirement ratio (RRR) that the central bank requires commercial banks to maintain. The reserve requirement ratio system requires banks to keep a certain percentage of their deposits with the central bank, limiting the amount of funds that financial institutions can freely use for lending and investment. The purpose of reducing the reserve requirement ratio is to increase liquidity, promote lending and stimulate economic activity by allowing financial institutions to release some of their reserves to the market.

Applicable Scene

It is usually implemented when the economic slowdown or external economic shocks lead to increased capital demand from enterprises and individuals, but it is difficult for funds to circulate in the market. For example, when economic growth slows and corporate capital investment and consumer activities decline, the central bank can reduce the deposit reserve ratio to expand banks’ lending capacity and make it easier for them to provide funds to the private sector. It is sometimes combined with interest rate policy. As a quantitative measure, lowering the deposit reserve ratio is as effective as lowering interest rates as an economic stimulus measure.

Pros: It is very effective and can send a clear signal of monetary easing to the market. In addition, since it can increase the money supply without changing the interest rate, it can support the economy while curbing the risk of excessive inflation. It is an effective tool, especially in emerging countries where there is a lot of room for credit creation and when the central bank has set the policy interest rate at a low level.

Cons: If implemented excessively, the market may see excess funds, which may trigger bubbles and inflationary pressure. In addition, an increase in the supply of funds does not necessarily mean an increase in loans to the real economy, so there is also a risk of falling into a “liquidity trap”. In addition, frequent interest rate cuts may cause the market to doubt the consistency of the central bank’s policy and undermine the credibility of monetary policy.

Legend

1. The central bank is reluctant to lower the reserve requirement ratio, leaving policy space for the next US government.

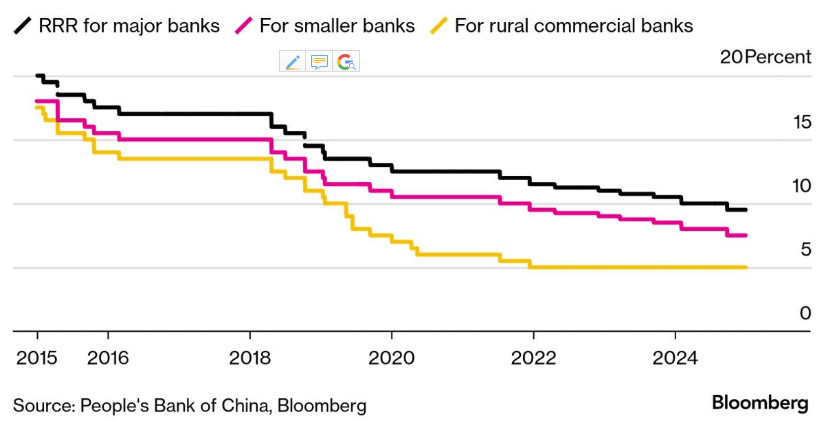

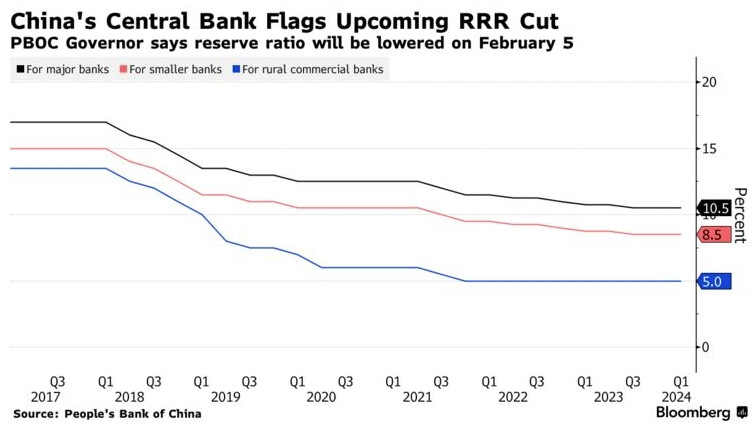

2. China will lower the reserve requirement ratio by 0.5 percentage points.

Related Article

Reference Link

https://english.www.gov.cn/news/202505/07/content_WS681af001c6d0868f4e8f2509.html

https://thecuriouseconomist.com/cutting-the-rrr-in-china/

https://www.cnbc.com/2024/01/24/china-to-cut-banks-reserve-ratio-by-50-basis-points-from-feb-5.html