Beta Coefficient | Web Scraping Tool | ScrapeStorm

Abstract:Beta Coefficient is a key indicator to measure the volatility of individual stocks or portfolios relative to the entire market, reflecting the systematic risk of assets, that is, the degree of risk associated with overall market changes. ScrapeStormFree Download

ScrapeStorm is a powerful, no-programming, easy-to-use artificial intelligence web scraping tool.

Introduction

Beta Coefficient is a key indicator to measure the volatility of individual stocks or portfolios relative to the entire market, reflecting the systematic risk of assets, that is, the degree of risk associated with overall market changes.

Applicable Scene

It is suitable for investors to evaluate the market risk of stocks or portfolios, adjust the risk level of portfolios, and calculate expected returns in the capital asset pricing model.

Pros: It can compare asset risks with the market, help investors judge relative risk levels, and provide a quantitative basis for investment decisions.

Cons: Relying on market benchmark selection, if the benchmark is inaccurate, the reference value will be reduced; and it will not be able to reflect the unique risks of the asset itself.

Legend

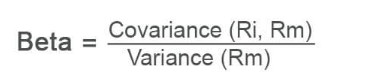

1. Beta Coefficient formula.

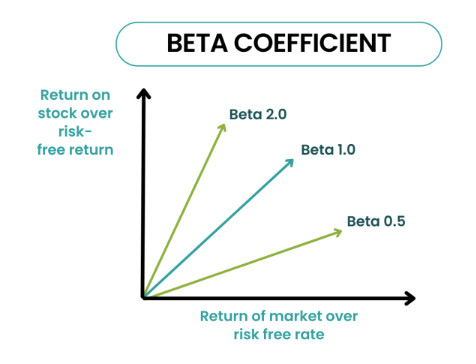

2. Beta Coefficient

Related Article

Reference Link

https://en.wikipedia.org/wiki/Beta_(finance)

https://corporatefinanceinstitute.com/resources/data-science/beta-coefficient/

https://corporatefinanceinstitute.com/resources/valuation/what-is-beta-guide/